virginia state ev tax credit

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. Reid D-32nd would have granted a state-tax rebate of up to 3500.

Latest On Tesla Ev Tax Credit March 2022

This credit is available for producers who generate up to two million gallons of biodiesel or renewable diesel fuel per year.

. To begin the federal government is offering several tax incentives for drivers of EVs. Federal Tax Incentives for Buying a Fuel-Efficient Car. However you should be.

An income tax credit is available for 50 of the cost of alternative fueling infrastructure up to 5000. Drive Electric Virginia is a project of. Many electric vehicles and hybrids currently on the market still qualify for the 7500 federal income tax credit.

According to Reuters the proposal included a boost for tax credits up to 12500 with an additional 4000 EV tax incentive for cars assembled in the US. Residential Federal Tax Credit Business Federal Tax Credit For Systems Installed. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

The Virginia State Corporation. January 1 2023 to December 31 2023. Alternatively the building must earn a ZEV or electric vehicle charging credit from the Virginia Energy Conservation.

EV market projections and statewide EV registration data to support the states 2045 net-zero carbon target in the. This incentive covers 30 of the cost with a maximum credit of up to 1000. The social spending and climate bill being considered in Congress includes up to.

Rebates would be funded for a maximum of 15 million per fiscal year and be issued on a first-come first-served basis. The annual credit may not exceed 5000 and producers are only eligible for the credit for the first three years of production. January 1 2020 to December 31 2022.

The EV rebate program would expire on July 1 2027. Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle.

Individuals that fall under certain household income guidelines would qualify for an enhanced rebate of an additional 50. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. Based on your EVs battery capacity and gross weight your credit can range from 2500 to 7500 provided it also has at least five kilowatt-hours of capacity and uses an external charging source.

Virginia State and Federal Tax Credits for Electric Vehicles 27. This tax credit can be utilized in conjunction with any rebates or incentive programs available through residents home. West virginia ev tax credit.

A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate. On or after January 1 2024. The rebate program would not apply to fleet purchases.

First 10 years following building occupancy. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

In its final form the program which would begin Jan. Qualifying infrastructure includes electric vehicle supply equipment and equipment to dispense fuel that is 85 or more natural gas propane or hydrogen. There are federal programs that when you purchase a fully electric vehicle you get a 7500 tax credit so that also helping the environment greater.

The maximum credit is 1000 per residential electric car charging station and 10000 for each public fueling station. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. A tax credit is also available for 50 percent of the equipment costs for the purchase and installation of alternative fuel infrastructure.

An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles. However only the original registered owner of a vehicle can claim the tax credit.

An additional 2000 rebate would be available for certain income qualified individuals. HB 1979 proposes that an individual who buys or leases a new or used electric motor vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a 2500 rebate. The Virginia Department of Mines Minerals and Energy must certify qualified producers.

Two companies General Motors and Tesla have been capped out of the 7500 tax credits since 2018. If someone tries to sell you on a pre-owned EV or hybrid by suggesting you could claim the tax credit they are incorrect. A bill proposed in mid-January by Virginia House Delegate David A.

This incentive covers 30 of the cost with a maximum credit of up to 1000. Review the credits below to see what you may be able to deduct from the tax you owe. To entice American taxpayers to go green the government offers numerous federal tax credits for buying a fuel-efficient vehicle such as one of the following.

However this credit will be phased out after 200000 electric models have been sold by a given manufacturer in the United States.

Biden Goal For U S Transition To Electric Vehicles Cast Into Doubt At U S Senate Hearing Virginia Mercury

Electric Car Tax Credits What S Available Energysage

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Virginia State And Federal Tax Credits For Electric Vehicles Pohanka Chevrolet

![]()

The 50 States Of Electric Vehicles State Lawmakers Focus On Incentives Fees And Government Procurement In Q1 2021 Nc Clean Energy Technology Center

Local Virginia And Maryland Electric Vehicle Tax Credits And Rebates Easterns

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

2022 Ev Tax Credits In Virginia Pohanka Automotive Group

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

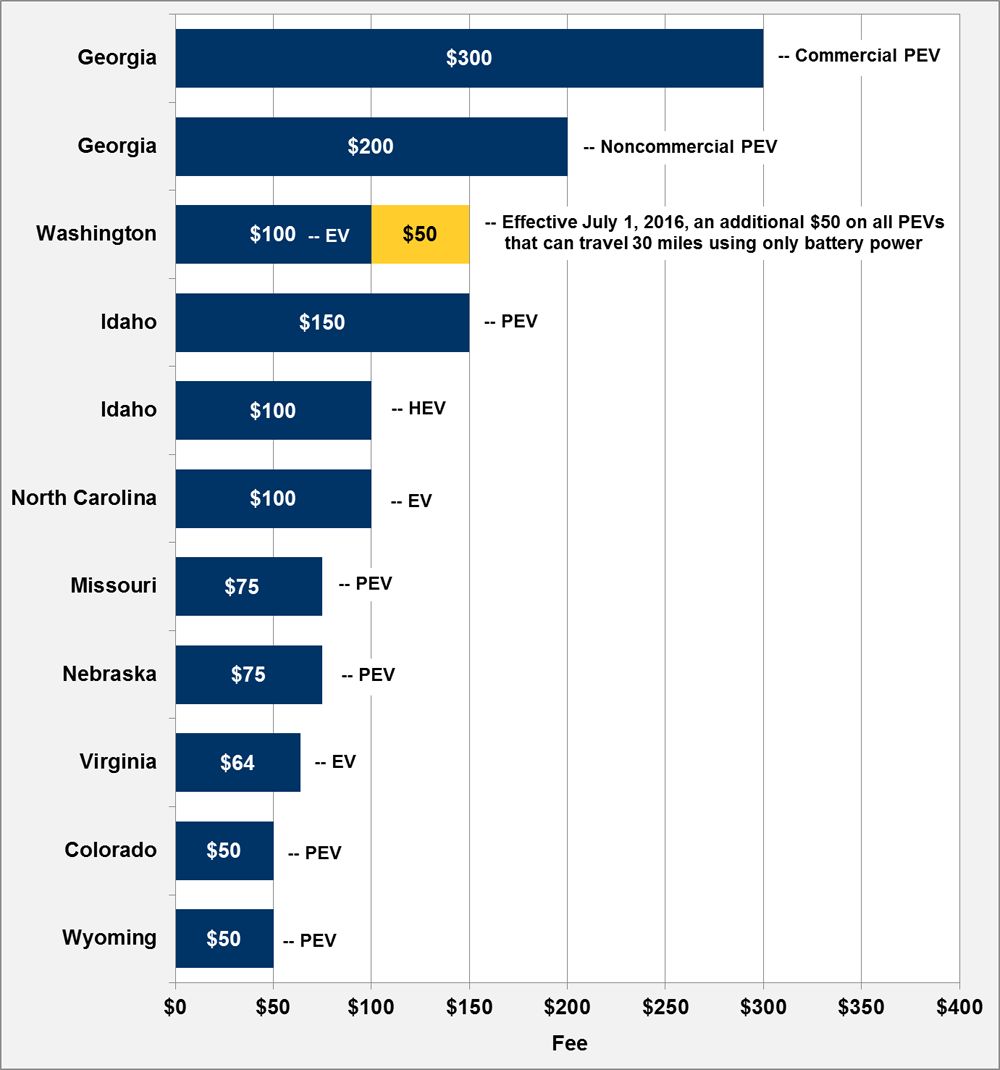

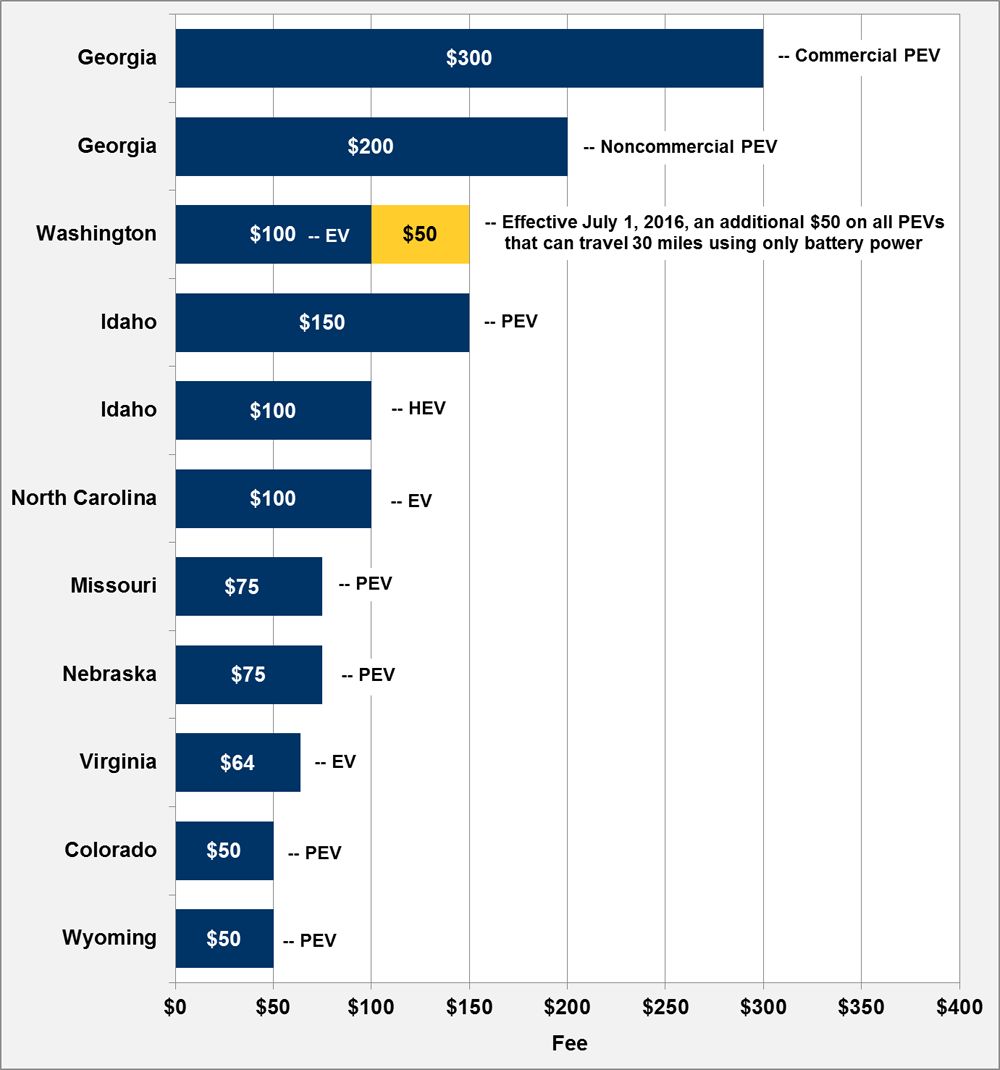

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Ev Charger Rewards Virginia Dominion Energy

Virginia Ev Rebate Legislation Proposed In 2021 Pluginsites

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Honda Of Chantilly

Groups Urge Dems To Preserve Imperiled Ev Tax Credit E E News

Rebates And Tax Credits For Electric Vehicle Charging Stations

2022 Ev Tax Credits In Virginia Pohanka Automotive Group

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Honda Of Chantilly